In analyzing the industry's current challenges, let's be careful before extrapolating about what they mean.

In analyzing the industry's current challenges, let's be careful before extrapolating about what they mean.

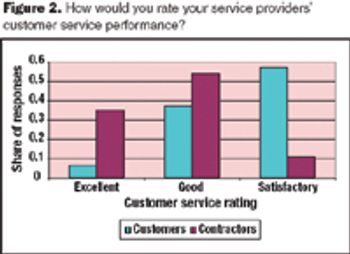

Meeting service levels is a major challenge for pharmaceutical services providers because the requirements of their client base vary widely.

There were notable approvals in nonparenteral delivery systems and biosimiliars in 2006.

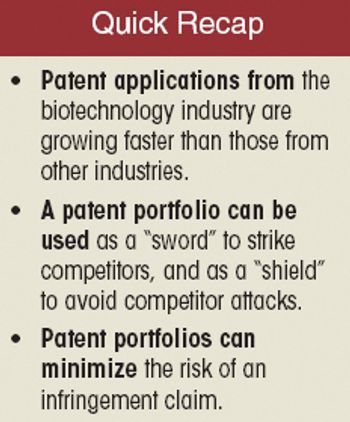

In light of these recent decisions, patent holders must devise new strategies for patent enforcement and licensing.

Closer examination shows there's a strong bond between the biotech market and the unraveling credit markets.

From the earliest days of the biotechnology industry, companies have grappled with the complexities of making innovative biopharmaceuticals on a large scale. Success in manufacturing begins with process science, since biotech production requires perfection in maintaining living organisms in a sterile environment under controlled physiological conditions. But unless companies can solve the challenge of planning for and managing manufacturing capacity, they will not be able to achieve the full potential of promising biotech products.

The center of gravity for the pharmaceutical market is shifting to the Asia-Pacific region from the US and Europe, according to an analysis published by PricewaterhouseCoopers (New York, NY, www.pwc.com).

The US Food and Drug Administration (FDA, Rockville, MD, www.fda.gov) issued a revised draft guidance on July 20 to help ensure that the safety, purity, and potency of biologics products is not compromised as a result of innovative, flexible manufacturing arrangements.

The August 7, 2007, issue of The Wall Street Journal Patent Scorecard ranks Wyeth (Madison, NJ, www.wyeth.com) first among 35 global pharmaceutical companies evaluated for patent-based intellectual property (IP).

For pandemic vaccine processing, single-use filter cartridges and membrane chromatography technologies could offer significant time- and cost-reduction advantages.

Vaccines against strains originating from avian flu may achieve poor yields in egg-based systems. Consequently, both public and private interest in alternative systems is high.

Understanding the end-to-end management of chemistry, manufacturing, and controls (CMC) resources provides the opportunity to enhance long-term planning, leverage development options, manage resource trade offs, and track progress against plans. The goal is to improve the pharmaceutical development process to deliver the pipeline. This article provides an overview of the organizational structure of Process Research and Development (PR&D) and the CMC teams at Genentech; the alignment of resources based on CMC contracts, process development activity maps and project resource plans; and the business economic analysis for evaluating development options.

When you start out, keep your small-cap exposure to no more than 10% of your holdings, and gradually increase.

The mounting threats of pandemic influenza, bioterrorism, and emerging infectious diseases continue to be the focus of research programs and funding initiatives, not only within governmental agencies, but also universities, private research firms, and commercial manufacturing entities. With all of these efforts, however, the question of manufacturing capacity and the ability to respond to pandemic and emerging threats continues to be a major concern.

In 2006, China exported a total of $890 million in biologics to other countries-a 30.61% increase, compared with the previous year.

Companies in the biotech industry typically require one or several partners as they complete the product development cycle.

Indian biotech revenues grew almost 31% to more than $2.08 billion in 2006–2007, according to a recent report.

In the April issue of BioPharm International, the article "BioPharmaceutical Operations Roadmap," provided a summary of the key industry gaps executives would like to close in the next 10 years. These goals came to my mind while I was attending Interphex this April in New York.

Sir Isaac Newton said, back in 1676, "If I have seen further, it is by standing on the shoulders of Giants." Newton's modest self-assessment of his scientific competence holds relevance in today's debate on the value of scientific meetings, and our quest for faster scientific discovery.

We're seeing an uptick in biotech investing from the venture capital community, a good sign that biotech can rise even higher than the broader markets.

The BIO annual meeting in early May had an upbeat tone. Investment capital is flowing into the industry at high levels, resulting in strong demand for contract development services. The funding stream is particularly strong in the US, and that is attracting more European contract manufacturers (CMOs) eager to improve business development here.

Most Chinese biopharmaceuticals are relatively small and there are not enough of them to sustain a robust services sector.

Quality guidelines are only as good as their implementation.

Roche (Basel, Switzerland, www.roche.com) has opened its new biotechnology production center in Basel.

The inaugural West Coast meeting for the Clinical Supplies Support Group (CSSG, www.jeiven.com/clinical_supplies_support_group.htm) was held in San Diego on June 8, 2007.