CDMOs can claim credit for the robust growth of emerging bio/pharma financings.

Jim Miller is president of PharmSource Information Services, Inc., and publisher of Bio/Pharmaceutical Outsourcing Report.

CDMOs can claim credit for the robust growth of emerging bio/pharma financings.

The industry will see an impact from financing, M&As, advanced therapies, generic drugs, and the retail market in 2018.

Recent acquisitions are creating CDMOs with scale that rivals global bio/pharma.

Mergers and acquisitions are positive for the CDMO industry, but there is a downside.

How has the bio/pharmaceutical contract manufacturing industry evolved and changed over the years and what does the future hold?

CMOs may be gaining as strategic partners to large bio/pharma companies, but they have a much harder path to navigate.

Moving global manufacturing operations may be more complicated than it appears.

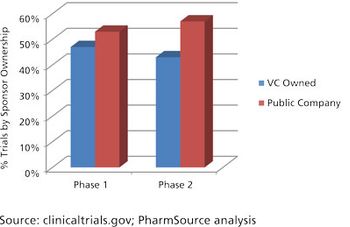

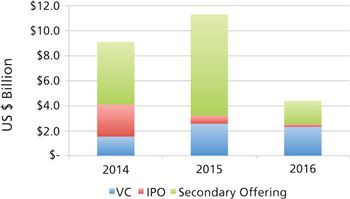

Robust venture capital investment gives CDMOs and CROs a positive outlook for 2017.

CMO executives are focusing on M&A activity, new business models, and fundraising limits.

The strategies of a innovation-driven CMO may be different than a capacity-driven CMO.

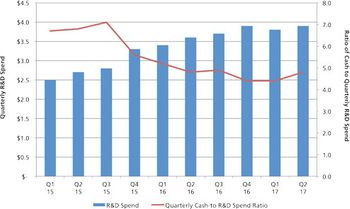

CDMOs need to be aware that unfavorable public markets put emerging bio/pharma R&D spending at risk in 2017.

Acquisition binges often lead to hangovers; here’s what to watch out for.

Demand is driving expansion and consolidation of formulation and clinical trial materials services.

Heightened global uncertainty could slow bio/pharma development activity.

CMO industry consolidation may be frustrated by a dearth of attractive assets.

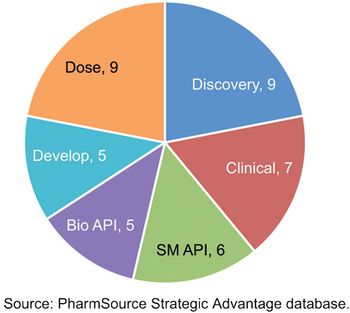

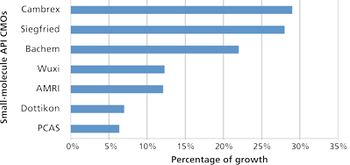

Despite emergence of biologics, small-molecule APIs benefit from industry growth.

While all market signs are pointing up, memories of past setbacks may discourage CDMOs from expanding capacity.

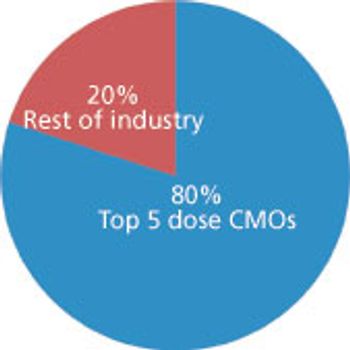

Big service providers get bigger faster thanks to Big Pharma.

Market forces may limit the success of CMOs.

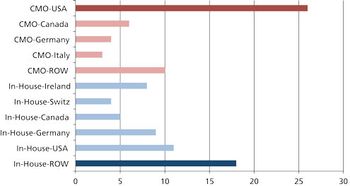

European CDMOs want into the US market, but entry options are limited.

The trend of exits from the CMO industry looks to be gaining momentum.

As payers refuse to cover new drugs, CMOs take a hit.

The CMO industry's value proposition is limiting its market penetration.

Changes in company ownership shake up the CMO industry.

The R&D model is in transition and creating new demands on contract services providers.

Ongoing changes create new opportunities for CROs and CMOs.

Practicality of implementation should be a part of vision in the bio/pharmaceutical industry.

Are strategic partnerships in clinical research a model for CMC services?

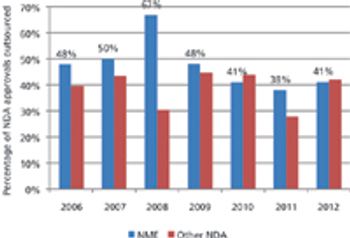

Approvals of new drugs are on an upward swing, but only a few CMOs are benefiting.

An innovative approach to capacity management.

Published: January 15th 2002 | Updated:

Published: February 15th 2002 | Updated:

Published: March 1st 2014 | Updated:

Published: December 1st 2013 | Updated:

Published: October 1st 2013 | Updated:

Published: September 1st 2013 | Updated: