Volatile Markets Take a Toll on Life-Sciences Initial Public Offerings

Volatile Markets Take a Toll on Life-Sciences Initial Public Offerings

The UK?s Technology Strategy Board has partnered with the Engineering and Physical Sciences Research Council (EPSRC) to invest as mush as £9 million ($14.2 million) in grant funding with the aim of bringing proof-of-concept ideas to pilot technology demonstration for healthcare.

Strong pipelines, approvals, and deals drive up market cap.

On Apr. 29, 2011, a federal appeals court has lifted a ban on federal funding for embryonic stem cell (ESC) research. The move was celebrated by researchers hoping to use such cells for research, but it is likely that the decision will be appealed. Embryonic stem cells are pluripotent cells derived from embryonic tissue in a process that usually results in the destruction of the embryo. The ban on funding did not apply to stem cells derived from adult tissue.

Industry starts the year with a positive spin.

President's Budget Allocates More Funding to FDA

Business models that were used to create current value are no longer going to be effective going forward.

Biotech's mid-sized elites position themselves for growth.

After a bright start to the year, some of biotech's blue chip companies have seen their early gains turn into losses.

As the capital markets in the US and globally continue to strengthen, the biotech industry can expect to see a rise in initial public offerings this year.

Biotech impressed investors with positive drug data, strong drug sales and earnings, and partnering deals.

Contract research, development, and manufacturing organizations betting on a comeback in venture capital financing will have a long wait.

Although the markets closed on a positive note in May, it will still take many more months before biotech starts on the road to full recovery.

Several legal considerations are key to protect the buyer and seller in royalty interest transactions.

Big biotechs will do just fine in the ongoing financial crisis, but the smaller companies will have more difficulty weathering the storm.

Biodefense start-up companies have an abundance of options when seeking funding.

What the current lack of venture capital means for the CRO market.

Small biotechs were forced to restructure and downsize.

The meltdown in the financial markets represents a sea change in the world of financing that will continue to affect the flow of much needed capital into the sector for the foreseeable future.

The biotech industry's year-to-date report card contains good grades despite the turbulent economic climate.

Health and Human Services Secretary Mike Leavitt has announced that his agency is amending its budget request for FY 2009 to include an additional $275 million for the FDA.

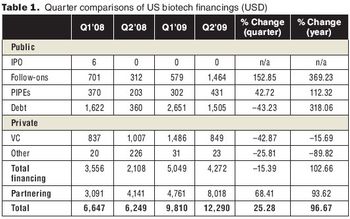

Following the market crisis of the first quarter of 2008, biotech IPOs and financing are down, but partnering continues, and mergers and acquisitions (M&As) remain hot.

Despite the rising fears about a slowing economy, the biotech industry will continue to maintain its momentum this year.

The biopharmaceutical sector can look forward to a financially flush venture funding environment in 2008

Like a snowball rolling down Mt. Everest, stem- cell research was gaining momentum, not only in political and medical arenas, but on Wall Street, too.