Gene therapy, immune-oncology, and digital healthcare technologies offer investors promise for innovation investments.

Chief Executive Officer at Burrill & Company

Gene therapy, immune-oncology, and digital healthcare technologies offer investors promise for innovation investments.

Life-sciences companies continue upward momentum in 2014.

Frenzy cools as investors seeking a quick return turn elsewhere.

Early-stage companies are now embraced by buyers of new issues.

Biotech companies raise most money in 13 years.

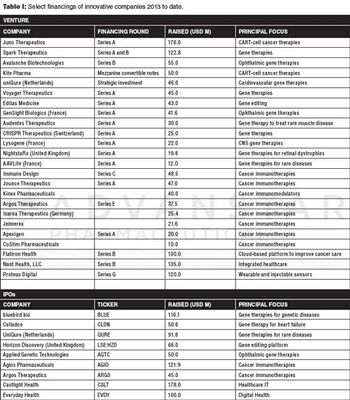

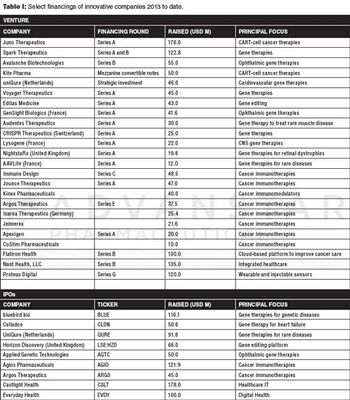

Early-stage companies are finding alternatives to venture capital.

A handful of therapeutics have performed extremely well in 2012, but as a whole, life-sciences are still down from 2010.

A handful of therapeutics have performed extremely well in 2012, but as a whole, life-sciences are still down from 2010.

Collaborative R&D models coincide with new ways to fund translational research.

Better news about the global economy buoys life-sciences funding.

Greater emphasis on focus and efficiency for companies as market demands value in 2012.

Volatile Markets Take a Toll on Life-Sciences Initial Public Offerings

Strong pipelines, approvals, and deals drive up market cap.

Industry starts the year with a positive spin.

Business models that were used to create current value are no longer going to be effective going forward.

Biotech's mid-sized elites position themselves for growth.

After a bright start to the year, some of biotech's blue chip companies have seen their early gains turn into losses.

As the capital markets in the US and globally continue to strengthen, the biotech industry can expect to see a rise in initial public offerings this year.

The companies that have survived the financial meltdown are well placed to adapt to the new environment that we now are entering.

Biotech impressed investors with positive drug data, strong drug sales and earnings, and partnering deals.

Although the markets closed on a positive note in May, it will still take many more months before biotech starts on the road to full recovery.

Big biotechs will do just fine in the ongoing financial crisis, but the smaller companies will have more difficulty weathering the storm.

Small biotechs were forced to restructure and downsize.

The meltdown in the financial markets represents a sea change in the world of financing that will continue to affect the flow of much needed capital into the sector for the foreseeable future.

The biotech industry's year-to-date report card contains good grades despite the turbulent economic climate.

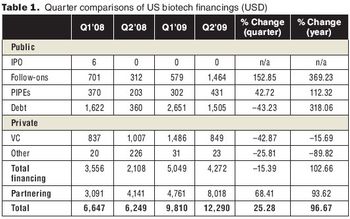

Following the market crisis of the first quarter of 2008, biotech IPOs and financing are down, but partnering continues, and mergers and acquisitions (M&As) remain hot.

Despite the rising fears about a slowing economy, the biotech industry will continue to maintain its momentum this year.

Thirty years after the first biotechnology company opened, the sector is reaching a new level of maturity and globalization.

by G. Steven Burrill, Burrill & Company Beleagured by bad news since the start of the year, biotech is barely registering a pulse on Wall Street . . . but it's hardly time to write the industry's obituary.

by G. Steven Burrill, Burrill & Company After a strong finish in 2001, biotech is back in the dumps.

Published: January 1st 2013 | Updated:

Published: April 1st 2014 | Updated:

Published: January 1st 2014 | Updated:

Published: October 1st 2013 | Updated:

Published: July 1st 2013 | Updated:

Published: April 1st 2013 | Updated: