Venture capital insiders say that the flow of funds into biopharma shouldcontinue, driven by the large amount of money available for investment.

Jim Miller is president of PharmSource Information Services, Inc., and publisher of Bio/Pharmaceutical Outsourcing Report.

Venture capital insiders say that the flow of funds into biopharma shouldcontinue, driven by the large amount of money available for investment.

The three largest players have accumulated, or are in the process of accumulating, nearly a million liters of capacity between them.

The number of projects in Lonza's internal biomanufacturing pipeline grew by 40% to over 75 projects.

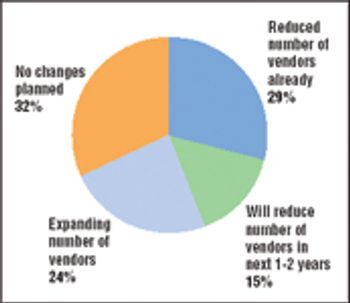

A major shift is occurring in the way the biopharmaceutical industry sources goods and services. Price pressures at the retail end of the value chain and a difficult fundraising environment are forcing biopharmaceutical companies to take greater control of their costs. Purchased goods and services, including contract research and manufacturing services as well as raw materials and laboratory supplies, are a major expense in most companies, so control of those purchasing decisions is coming in for special scrutiny.

The lack of biomanufacturer acquisitions seems surprising.

Interestingly, it is companies that already have the most capacity available to them that are building even more.

Moving aggressively to implement its Vision 2010 strategy, which debuted in October 2005, DSM N.V. (Heerlen, Netherlands) announced in December 2005 that it would shut down its Montreal biomanufacturing facility in early 2006. The move doesn't signal an exit from manufacturing, however, but a change in focus; DSM will simultaneously expand its expression-technology relationship with Crucell (Leiden, the Netherlands). Both moves reflect changing circumstances in the biomanufacturing sector.

In addition to India and China, other Asian countries are establishing themselves as destinations for biopharma companies.

Avariety of forces are combining to fundamentally change the financial dynamics of the biopharmaceutical industry. The initial public offering (IPO) appears to be giving way to licensing arrangements with, and acquisitions by, major pharmaceutical companies.

The contract manufacturing sector has not enjoyed the success of preclinical and clinical businesses.

Technology innovations aimed at increasing yields and shortening development times can be very cost-effective, promising to reduce the need for large capital investments while getting the client into the clinic much faster.

Current productivity initiatives may be too little, too late ? a more drastic overhaul may be required.

Publicly traded CROs and CMOs reported solid financial results in their most recent quarter, but the big news at October's AAPS meeting was the substantial rise in new RFPs and contracts.

As FDA tries to bring pharmaceutical manufacturing into the 21st century, changes are likely to favor companies with greater manufacturing expertise and the means to invest in new technoglogies.

Outsourcing is in the public eye as politicians debate the lag in job growth despite a recovering economy, and the Bush Administration seeks to ?competitively source? more agency activities.

CROs and CMOs have reported on their second quarter financial performance during July and August. Although revenues and profits were up for most companies reporting, the discussions of market conditions surrounding the financial results had a somewhat unsettled feel. Most contractors expect robust revenues in the second half of 2003 but are clearly nervous about whether the activity will actually materialize.

BIO 2003 offered many insights into biopharma's future.

A Dutch biotech company?s $100 million investment puts the spotlight on biomanufacturing capacity

by Jim Miller, Bio/Pharmaceutical Outsourcing Report Contract research organizations that provide multiple services look appealing again to big biopharmaceutical companies.

by Jim Miller, Bio/Pharmaceutical Outsourcing Report Developments in 2002 such as acquisitions, excess manufacturing capacity, and less funding for biotechnology will continue to affect the industry long into the new year.

by Mark Tuomenoska, OpenReach, Inc. and Jim Miller, Bio/Pharmaceutical Outsourcing Report Outsourcing can be a booster rocket in the race to patent and market innovative products.

by Jim Miller and Janet Lowenbach, PharmSource Information Services The EU must harness market forces that reward innovation and competitiveness to combat its current R&D drain.

by Jim Miller, Bio/Pharmaceutical Outsourcing Report If a CRO or contract manufacturer was outperforming others in the industry, would anybody notice?

by Les Blumberg, The Warren Company, and Jim MIller, Bio/Pharmaceutical Outsourcing Report Strategic Outsourcing requires discipline so companies can realize the competitive benefits in the marketplace

by Jim Miller, PharmSource Information Services, David S. Zuckerman, Customized Improvement Strategies, and Michael B. Higgins, Belgard Consulting A sponsor?contractor team can prevent relationship failures by using a good team strategy to overcome organizational, cultural, and functional boundaries.

by Jim Miller, PharmSource Information Services, Inc. and Edward P. Moser

by Jim Miller, and Edward P. Miller, PharmSource Informaton Services, Inc. Today, reverse auctions are perceived more realistically than in years past, but they still offer many benefits for both buyer and seller.

by Jim Miller, PharmSource Information Services, Inc. Tough economic times have prompted CROs to reflect on their past performance and to create potential solutions for the future.

by Heather B Hayes, a freelance writer, and Jim Miller, publisher of the Bio/Pharmaceutical Outsourcing Report EVA allows project managers to refer to tangible numbers, not just a gut feeling, in determining whether a project is advancing on time and within budget.