In China, the presence of a substantial biogenerics industry reflects a growing need to provide healthcare to domestic populations, at a reasonable cost.

In China, the presence of a substantial biogenerics industry reflects a growing need to provide healthcare to domestic populations, at a reasonable cost.

Venture capital insiders say that the flow of funds into biopharma shouldcontinue, driven by the large amount of money available for investment.

The three largest players have accumulated, or are in the process of accumulating, nearly a million liters of capacity between them.

China is home to more than 400 biogeneric manufacturers, which develop generic biopharmaceuticals for the domestic population.

The number of projects in Lonza's internal biomanufacturing pipeline grew by 40% to over 75 projects.

Offshoring to China has captured the imagination of Western managers seeking to reduce operating costs. What is the best approach?

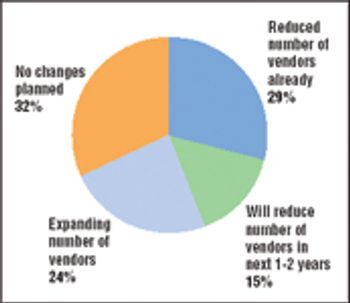

A major shift is occurring in the way the biopharmaceutical industry sources goods and services. Price pressures at the retail end of the value chain and a difficult fundraising environment are forcing biopharmaceutical companies to take greater control of their costs. Purchased goods and services, including contract research and manufacturing services as well as raw materials and laboratory supplies, are a major expense in most companies, so control of those purchasing decisions is coming in for special scrutiny.

The lack of biomanufacturer acquisitions seems surprising.

Interestingly, it is companies that already have the most capacity available to them that are building even more.

Moving aggressively to implement its Vision 2010 strategy, which debuted in October 2005, DSM N.V. (Heerlen, Netherlands) announced in December 2005 that it would shut down its Montreal biomanufacturing facility in early 2006. The move doesn't signal an exit from manufacturing, however, but a change in focus; DSM will simultaneously expand its expression-technology relationship with Crucell (Leiden, the Netherlands). Both moves reflect changing circumstances in the biomanufacturing sector.

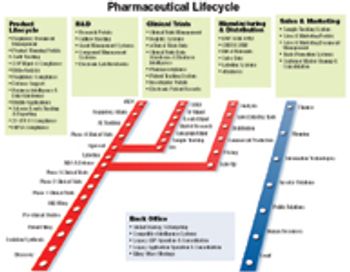

Achieving approval of a new pharmacologic agent or device on a worldwide basis is a significant challenge. The guidelines and requirements that steer our efforts at enhancing and extending life around the world are tedious and, fortunately, comprehensive. In spite of relatively few setbacks, perhaps in no other category than pharmaceutical development are the advantages of these guidelines more evident.

IT, payroll, manufacturing, and clinical-trial data management are key areas for growth in biopharm outsourcing efforts.

In addition to India and China, other Asian countries are establishing themselves as destinations for biopharma companies.

Avariety of forces are combining to fundamentally change the financial dynamics of the biopharmaceutical industry. The initial public offering (IPO) appears to be giving way to licensing arrangements with, and acquisitions by, major pharmaceutical companies.

Less than 35 percent of all biotech companies have sufficient finances to survive beyond one year.

Your company's job is to make biopharmaceutical products. Managing facilities is a function supporting the main task. General manufacturing companies discovered this long ago, but pharmaceutical producers have been lagging. Once you consider the outsouring of non-core activities like facility management (FM), office services, space planning, and utilities management, you can focus on core business functions that make profits.

The contract manufacturing sector has not enjoyed the success of preclinical and clinical businesses.

Project management is a specific set of skills and processes administered to meet the specific complexities of a project.

Life sciences firms haven't exactly been jumping on the offshore outsourcing bandwagon. But faced with unprecedented cost constraints, competitive pressures, and regulatory scrutiny, the industry needs new solutions to its business problems. Some experts think information technology (IT) "offshoring" offers a solid alternative; others question the idea.

Technology innovations aimed at increasing yields and shortening development times can be very cost-effective, promising to reduce the need for large capital investments while getting the client into the clinic much faster.

Current productivity initiatives may be too little, too late ? a more drastic overhaul may be required.

Biopharmaceutical companies can access their suppliers? resources to reduce validation and compliance efforts.

A Dutch biotech company?s $100 million investment puts the spotlight on biomanufacturing capacity

by Jim Miller, PharmSource Information Services, Inc. Tough economic times have prompted CROs to reflect on their past performance and to create potential solutions for the future.