Industry experts discuss what the outsourcing market holds for 2016.

Industry experts discuss what the outsourcing market holds for 2016.

CMO industry consolidation may be frustrated by a dearth of attractive assets.

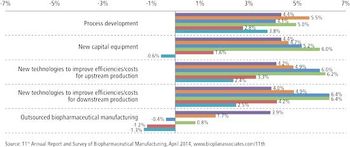

Better process development is creating industry benchmarks for bioprocessing.

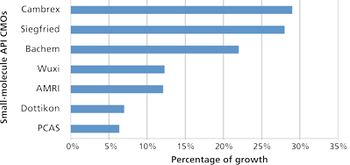

Despite emergence of biologics, small-molecule APIs benefit from industry growth.

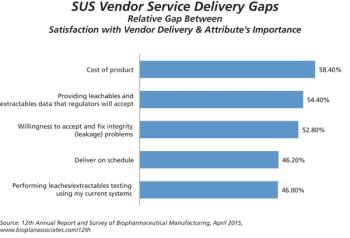

Suppliers indicate prices for single-use equipment are likely to increase.

Biopharma companies are outsourcing more jobs to cut costs.

While all market signs are pointing up, memories of past setbacks may discourage CDMOs from expanding capacity.

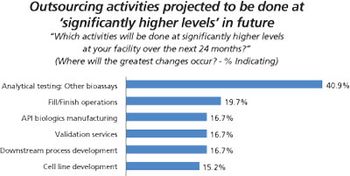

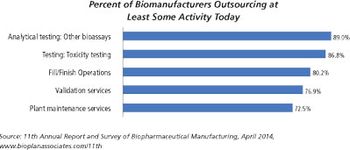

Biopharma companies on both sides of the Atlantic ship more of their assay testing to outside service providers.

While the United States and Europe still dominate, CMOs and CROs based in emerging markets continue to capture market share.

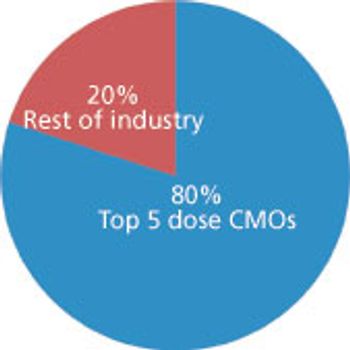

Big service providers get bigger faster thanks to Big Pharma.

Is there enough talent to go around?

Market forces may limit the success of CMOs.

There are significant differences between small molecules and biologics fill/finish capacity.

Outsourcing is taking on a greater role in the biopharmaceutical manufacturing industry.

European CDMOs want into the US market, but entry options are limited.

The trend of exits from the CMO industry looks to be gaining momentum.

Annual study shows geographic proximity not a factor in CMO selection.

With budgets growing, clients see CMOs' costs as less crucial.

The CMO industry's value proposition is limiting its market penetration.

Outsourcing activity remains strong and unlikely to abate, especially in more traditional areas.

Changes in company ownership shake up the CMO industry.

CMOs may find opportunities in alternative expression services.

The R&D model is in transition and creating new demands on contract services providers.

Ongoing changes create new opportunities for CROs and CMOs.

Data from BioPlan Associates' 10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production suggest that the interest in disposable devices has begun to extend to biopharma operations beyond basic single-use bags and connectors.