By outsourcing high-end processes that demand advanced analytical and technical skills, biopharm companies are reaping substantial savings.

The BIO annual meeting in early May had an upbeat tone. Investment capital is flowing into the industry at high levels, resulting in strong demand for contract development services. The funding stream is particularly strong in the US, and that is attracting more European contract manufacturers (CMOs) eager to improve business development here.

By outsourcing high-end processes that demand advanced analytical and technical skills, biopharm companies are reaping substantial savings.

Partnering with a surging number of CROs, CMOs, CSOs, and other niche providers, biopharm companies in 2007 will have an estimated spend of more than $7 billion on international clinical trial outsourcing alone.

Consider the number of patients, the dose each will receive (and how this dose is calculated), the number of doses per patient, and what overage is needed to allow for vial breakage.

The greatest benefits of outsourcing are realized when a company takes a strategic approach rather than a tactical approach.

The contract manufacturer must have sufficient capacity so it can absorb possible surge in demand, and back-up capability in case of a power failure or other event.

The three largest players have accumulated, or are in the process of accumulating, nearly a million liters of capacity between them.

The changes in biologics manufacturing regulations contained in the 1997 FDA Modernization Act significantly bolstered the growth of CMOs.

In the rush to save money, the consequences of potential problems often are ignored.

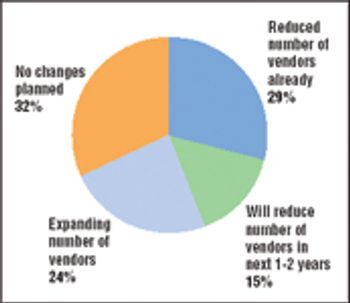

A major shift is occurring in the way the biopharmaceutical industry sources goods and services. Price pressures at the retail end of the value chain and a difficult fundraising environment are forcing biopharmaceutical companies to take greater control of their costs. Purchased goods and services, including contract research and manufacturing services as well as raw materials and laboratory supplies, are a major expense in most companies, so control of those purchasing decisions is coming in for special scrutiny.

The lack of biomanufacturer acquisitions seems surprising.

Interestingly, it is companies that already have the most capacity available to them that are building even more.

Moving aggressively to implement its Vision 2010 strategy, which debuted in October 2005, DSM N.V. (Heerlen, Netherlands) announced in December 2005 that it would shut down its Montreal biomanufacturing facility in early 2006. The move doesn't signal an exit from manufacturing, however, but a change in focus; DSM will simultaneously expand its expression-technology relationship with Crucell (Leiden, the Netherlands). Both moves reflect changing circumstances in the biomanufacturing sector.

Before designing cleaning procedures, it's vital to know all physical and chemical characteristics of the product ingredients.