- BioPharm International-02-01-2018

- Volume 31

- Issue 2

Opportunities and Obstacles for Generic Drugs

Manufacturers tackle regulatory and competitive issues to develop complex therapies and biosimilars.

Generic drugs account for nearly 90% of prescription drugs in the United States due to policies that facilitate their development and regulatory approval. Despite this success, generic-drug makers face multiple legal and competitive hurdles to ensuring patient access to less costly, high-quality medicines. Tight profit margins on conventional generics discourage investment in modern manufacturing systems, resulting in contaminated and violative products that lead to recalls and shortages. Price hikes on established products, moreover, have generated a backlash and allegations of collusion and price gouging.

The result is a financial and operational squeeze on the generic-drug industry. Teva Pharmaceuticals is undergoing a major corporate overhaul to address financial difficulties, involving massive layoffs and the shuttering of manufacturing and R&D facilities. Novartis’ Sandoz division says that price pressures may lead to reductions in its US product portfolio and a greater focus on developing biosimilars and complex formulations.

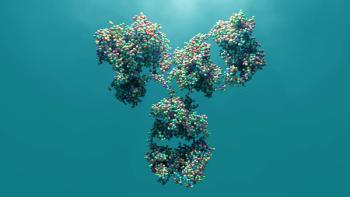

Fierce competition between brand and generic-drug makers adds to these difficulties. Most of the nine biosimilars approved by FDA remain off the market due to patent issues. Yet, FDA

Brand “shenanigans”

A major complaint of generic-drug makers is that pharma companies block access to reference drug samples needed for bioequivalence testing and biosimilar development by abusing restricted distribution programs such as Risk Evaluation and Mitigation Strategies (REMS). The availability of generic medicines “is in jeopardy,”

These topics were explored at an FDA public meeting in July 2017, where industry representatives and medical authorities discussed citizen petitions, labeling issues, late formulation changes, and use of REMS to stymie new generic testing. Similar issues were raised at a November 2017 Federal Trade Commission (FTC) workshop on “Understanding Competition in US Prescription Drug Markets.” In opening the meeting, FDA Commissioner Scott Gottlieb emphasized that more streamlined development and approval of generic drugs and biosimilars is key to ensuring consumer access to needed medicines.

Congress is paying attention to these concerns as it seeks strategies for managing drug costs and outlays. At a July 2017 hearing before the House Judiciary Committee, Gottlieb

More competition

In June 2017, Gottlieb implemented a

Equally important are FDA efforts to streamline the overall process for evaluating and reviewing all new generics. A sign of success is the approval of more than 1000 new generics in 2017. Much credit goes to the generic drug user fee program (Generic Drug User Fee Amendments, GDUFA), which was established five years ago and recently reauthorized as GDUFA II. The fees have provided additional resources for the Office of Generic Drugs (OGD) in FDA’s Center for Drug Evaluation and Research (CDER) to reduce a huge backlog in unapproved abbreviated new drug applications (ANDAs) and to achieve a more predictable review process.

OGD Director Kathleen Uhl

FDA also is requiring that all applications include a complete list of relevant manufacturing operations to avoid delays in plant inspections involved in approving a new product. This is particularly important for priority ANDAs that may qualify for a faster eight-month review. But the request to see a full roster of facilities involved in product testing and production two months before ANDA submission has raised an outcry from manufacturers that the timeframe is inoperable and defeats the purpose of the priority review process.

Seeking balance

The challenge to FDA and industry is to maintain a balance between encouraging the development of important new medical therapies and assuring access to low-cost follow-on medicines. While generic-drug makers complain about innovator firms using patent strategies and supply restrictions to delay competition, bio/pharma companies emphasize the need for incentives to test new therapies and develop added indications to an effective drug; and for labeling to ensure safe and appropriate use of a therapy. So far, there has been limited response to FDA’s list of drugs that lack generic competition, particularly where markets are small and product development is complex and costly. Some gains may come from efforts by regulatory authorities in different regions to harmonize the use of new methods for developing and approving new generics and to adopt common dossiers to facilitate product approvals in multiple markets.

At the same time, continued pressure on generic-drug prices may reduce product development and limit manufacturing in the US. Numerous state officials have filed lawsuits against generic-drug makers for alleged price-fixing, and debate continues over brand vs. generic product labeling to warn consumers about safety issues. All these trends will shape generic-drug production and costs in the coming months.

References

1. FDA, “

2. AAM, “

3. FDA,

4. FDA,

5. S. Gottlieb, “

6. FDA,

7. K. Uhl, “

8. FDA, Statement From FDA Commissioner Scott Gottlieb, MD on New Steps to Facilitate Efficient Generic Drug Review to Enhance Competition, Promote Access And Lower Drug Prices, FDA.gov, Jan.3, 2018.

Article Details

BioPharm International

Vol. 31, No. 2

February 2018

Pages: 6-7

Citation

When referring to this article, please cite it as J. Wechsler, "Opportunities and Obstacles for Generic Drugs," BioPharm International 31 (2) 2018.

Articles in this issue

about 8 years ago

Impurity Testing of Biologic Drug Productsabout 8 years ago

The Ins and Outs of LC-Based Analytical Tools and Techniquesabout 8 years ago

Tabletop Peristaltic Liquid-Filling Machineabout 8 years ago

USB Data Logger for Temperature-Sensitive Productsabout 8 years ago

Maintaining Lab Data Integrityabout 8 years ago

Navigating Data Integrity in the Modern Lababout 8 years ago

Designing a Single-Use Biopharmaceutical Processabout 8 years ago

Container Closures: Leaving Nothing to Chanceabout 8 years ago

A New Business Model for Pharma?about 8 years ago

FDA Framework Spurs Advanced TherapiesNewsletter

Stay at the forefront of biopharmaceutical innovation—subscribe to BioPharm International for expert insights on drug development, manufacturing, compliance, and more.