COVID-19 Upends Business-as-usual Research and Regulatory Practices

Now officially a worldwide pandemic, the biomedical research community is rushing to develop treatments and preventives to halt the spread and severity of the COVID-19 virus.

Now officially a worldwide pandemic, the biomedical research community is rushing to develop treatments and preventives to halt the spread and severity of the COVID-19 virus. Political infighting has stymied an effective response in the US, with much finger-pointing on all sides. As the severity of the disease becomes more starkly apparent, schools and communities have shut down and cancellations have hit most travel, sports, and business and professional meetings.

An efficient effort by the US health care system to identify and isolate infected individuals has been undermined by a lack of fast and available diagnostics, and remedies have been derailed by political missteps and administrative failings. Short supplies of test kits and of reagents have forced clinics and hospitals to turn away most individuals with mild symptoms, but still capable of infecting others. FDA has granted “emergency use authorization” for additional test kits, including a faster test system produced by Roche and widely available in Europe and other countries, while researchers moved to develop new blood-based tests that may be easier to administer and assess. But the delay has been costly, and damaging to FDA, the Centers for Disease Control and Prevention (CDC), and confidence in the nation’s ability to control the pandemic.

Adding to the difficulties of distributing more coronavirus test kits, is a serious lack of supplies needed to extract genetic material from a virus in a patient’s test sample. Labs also face shortages of protective gear and other items commonly used to swab patients and collect samples.

Legislators scrutinize supply chain

The pandemic has also heightened ongoing concerns about the growing reliance of pharmaceutical manufacturers on vital ingredients produced in China, India, and other foreign countries, an issue that has raised an outcry on Capitol Hill and concern at FDA and industry. While shortages in face masks and protective gear have been an immediate problem, China’s prominence in producing key active pharmaceutical ingredients (APIs) for antibiotics and many common medicines has raised alarms. Last week, the Indian government ordered domestic pharmaceutical manufacturers to halt the export of 26 drugs and drug ingredients, and other countries are looking closely at the need for similar actions to protect domestic supplies.

The situation is spurring politicians to press for “buy American” drug programs to reduce the dependence of US industry on APIs and medical products imported from overseas. There is talk of initiating such policies at federal agencies that purchase or pay for large volumes of pharmaceuticals, such as the Departments of Defense, of Veterans Affairs, and Medicare and Medicaid. One bi-partisan measure authorizes FDA to request information from manufacturers of “essential” drugs or medical devices on the sources of API and component parts – specific data that FDA acknowledges it does not have. It also extends to medical devices requirements for drugs to report anticipated shortages. So far FDA has identified only one drug in shortage due to supply disruptions related to COVID, but the situation is under close scrutiny.

Another measure promotes continuous manufacturing and other advanced pharmaceutical production methods to encourage investment in such systems in the US, and, in the process, reduce shortages and dependence on foreign supplies. Congress included in a recent emergency supplemental budget bill some $20 million to promote advanced drug manufacturing efforts, which may also support improving flu vaccine production methods.

Spurring research

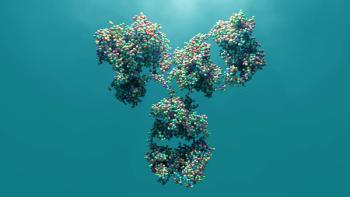

Meanwhile the race is on to identify and test potential treatments and vaccines to counter the COVID-19 virus. The World Health Organization (WHO) reports nearly 400 global clinical trials underway related to the coronavirus. Gilead Sciences has grabbed headlines by ramping up studies with the National Institutes of Health (NIH) and academic researchers to determine if its experimental antiviral for Ebola, remdesivir, might be effective against COVID-19. Takeda announced plans to develop a plasma-derived therapy for infected patients. Several firms are examining whether approved HIV therapies or treatments for rheumatoid arthritis might be effective against coronavirus infections. Pressure to join the competition is prompting new partnerships among established biopharma companies and smaller biotechs that hold evidence that an experimental monoclonal antibody or other compound might be a viable treatment candidate.

In addition, some 35 potential vaccines are under development by companies and research institutes. Inovio Pharmaceuticals and Moderna are enrolling volunteers, while Johnson & Johnson and Sanofi look to launch trials in the coming months. One controversial issue is the plan to start early human testing for some promising vaccines without first conducting the usual animal studies designed to gain data on safety and effectiveness; in this case animal studies may be important for ruling out the risk of “vaccine enhancement” which can make the disease even worse in an individual.

Meanwhile, the biopharma community has not escaped direct hits from COVID-19. In February, a strategy meeting involving some 175 senior managers at Biogen in Boston, MA resulted in infecting more than 70 attendees. The slow US response for identifying infected individuals, especially those with mild symptoms, has skewed upward the percentages of deaths and severe cases. However, it remains to be seen just how deadly the pandemic will become and how long it will play out.

Newsletter

Stay at the forefront of biopharmaceutical innovation—subscribe to BioPharm International for expert insights on drug development, manufacturing, compliance, and more.